The Paycheck Protection Program (PPP) was a financial lifeline extended to businesses during the COVID-19 pandemic, aimed at keeping workers employed and businesses afloat. This program, initiated by the U.S. government, provided forgivable loans to help businesses cover payroll costs and other essential expenses. One of the most intriguing aspects of the PPP is the list of names, which includes the beneficiaries who received the loans. This list has garnered significant attention, raising questions about transparency, fairness, and the impact of the program on diverse sectors. Understanding the intricacies of the PPP loan list of names can offer valuable insights into the distribution and effectiveness of the program.

The PPP loan list of names serves as a crucial public record, offering transparency regarding the allocation of funds. It reveals the businesses and organizations that benefited from the loans, highlighting trends in how different industries and regions of the country were impacted. For policymakers, researchers, and the general public, this list provides an opportunity to analyze the effectiveness of the program and assess whether the intended goals were achieved. Furthermore, it brings to light any disparities or inequities in the distribution of funds, prompting discussions on how future aid programs can be more equitable.

An in-depth exploration of the PPP loan list of names also sheds light on the broader economic and social implications of the program. By examining the data, one can identify which industries were most reliant on PPP loans and how these funds contributed to retaining jobs and sustaining businesses. Moreover, the list can help evaluate the program's role in stabilizing the economy during a period of unprecedented challenges. Through this comprehensive guide, we aim to provide a detailed overview of the PPP loan list of names, its significance, and the lessons learned from its implementation.

Table of Contents

- Understanding the PPP Program

- Importance of the PPP Loan List

- Analyzing the PPP Loan Data

- Transparency and Accountability

- Industries Impacted by PPP Loans

- Regional Distribution of PPP Loans

- Small Businesses and PPP Loans

- Controversies Surrounding the PPP List

- Success Stories from the PPP

- Lessons Learned from the PPP

- Future of Government Aid Programs

- Impact of the PPP on Employment

- Economic Recovery and the PPP

- Ethical Considerations in Loan Distribution

- Conclusion

Understanding the PPP Program

The Paycheck Protection Program (PPP) was established as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020. The primary goal of the PPP was to provide financial support to small businesses in the United States to help them maintain their workforce during the economic downturn caused by the COVID-19 pandemic. The program allowed businesses to apply for loans that could be fully forgiven if they met specific criteria, such as using a significant portion of the funds for payroll expenses.

Administered by the Small Business Administration (SBA), the PPP was designed to expedite the process of getting funds to businesses in need. The loans were distributed through participating lenders, including banks and credit unions, which worked with the SBA to process applications and disburse funds. The program was implemented in several phases, with each phase providing additional funding and expanding eligibility criteria to reach more businesses.

The response to the PPP was overwhelming, with millions of businesses applying for loans. The program's structure was intended to encourage businesses to keep employees on the payroll, thus reducing the burden on unemployment insurance systems and promoting economic stability. However, the rapid rollout of the program also led to challenges and criticisms, particularly concerning the distribution of funds and the criteria for loan forgiveness.

Importance of the PPP Loan List

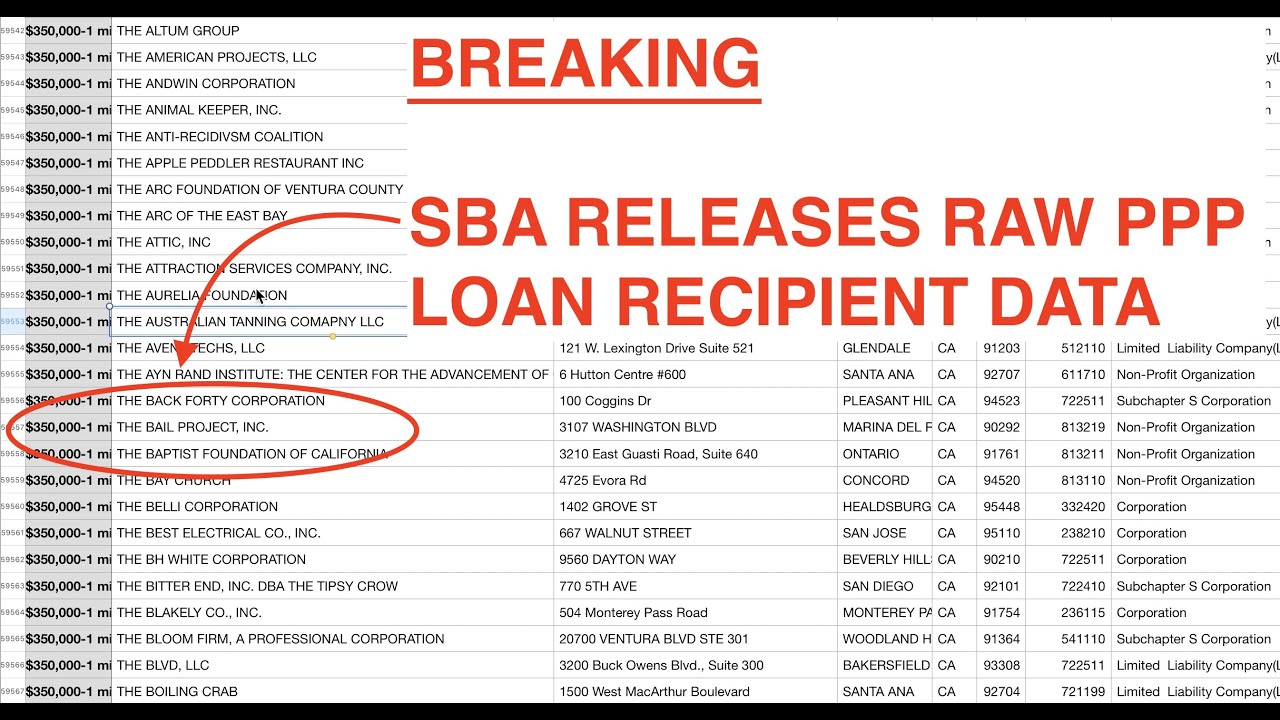

The PPP loan list of names is a critical component of the program's transparency and accountability measures. By making the list publicly available, the government aimed to provide insight into how taxpayer dollars were being used and ensure that the funds reached those most in need. The list includes information on the recipients of PPP loans, the amount of each loan, and the purpose for which the funds were intended.

This transparency is essential for several reasons. First, it allows for public scrutiny of the program, helping to identify any misuse of funds or discrepancies in the allocation process. Second, it provides valuable data for researchers and policymakers to analyze the effectiveness of the PPP and identify areas for improvement. Lastly, the list serves as a tool for businesses and individuals to learn from the experiences of others, potentially guiding future decision-making in similar situations.

Despite its significance, the release of the PPP loan list has been met with controversy. Some businesses have expressed concerns about privacy and the potential for reputational harm if they are perceived as having received government aid. Nevertheless, the benefits of transparency and accountability are considered to outweigh these concerns, contributing to a more informed and engaged public.

Analyzing the PPP Loan Data

The PPP loan data provides a wealth of information that can be used to assess the program's impact and effectiveness. By examining the data, analysts can identify trends and patterns in the distribution of loans, such as which industries received the most funding and how the funds were allocated across different regions. This analysis can help determine whether the program achieved its intended goals and highlight any areas where improvements are needed.

One of the key aspects of analyzing the PPP loan data is understanding the distribution of funds among different business sizes. While the program was designed primarily for small businesses, some larger companies also received loans, leading to debates about the fairness of the allocation process. By examining the data, researchers can assess whether the funds were equitably distributed and whether small businesses were adequately supported.

Additionally, the PPP loan data can provide insights into the economic impact of the program. By tracking changes in employment and business performance among loan recipients, analysts can gauge the extent to which the funds contributed to economic stability and recovery. This information is crucial for evaluating the program's success and informing future policy decisions.

Transparency and Accountability

Transparency and accountability are fundamental principles underpinning the PPP. The public release of the PPP loan list of names was a significant step toward ensuring that these principles were upheld. By providing visibility into how the funds were distributed, the government aimed to foster trust and confidence in the program's integrity.

However, achieving transparency and accountability in the PPP was not without challenges. The rapid rollout of the program, combined with the sheer volume of applications, led to instances of fraud and misuse of funds. To address these issues, the SBA and other oversight bodies implemented measures to detect and prevent fraud, such as auditing loan recipients and collaborating with law enforcement agencies.

Despite these efforts, some critics argue that more could have been done to enhance transparency and accountability in the PPP. For example, there were calls for more detailed reporting on how businesses used the funds and stricter enforcement of eligibility criteria. These lessons can inform future aid programs, ensuring that transparency and accountability are prioritized from the outset.

Industries Impacted by PPP Loans

The PPP loan list of names reveals significant insights into the industries most impacted by the program. The hospitality and food service sectors, for example, were among the hardest hit by the pandemic due to widespread shutdowns and restrictions. As a result, these industries received a substantial portion of the PPP loans, helping them weather the economic downturn.

Other industries that benefited from PPP loans include retail, healthcare, and manufacturing. These sectors faced unique challenges during the pandemic, such as supply chain disruptions and increased demand for certain products and services. The PPP loans provided much-needed financial support to help these businesses navigate the uncertainties and continue operating.

By analyzing the PPP loan data, researchers can assess the program's impact on different industries and identify which sectors were most reliant on government assistance. This information can inform future policy decisions and help tailor support to the specific needs of various industries during economic crises.

Regional Distribution of PPP Loans

The distribution of PPP loans across different regions of the United States is another critical aspect of the program's impact. The PPP loan list of names provides valuable data on how funds were allocated geographically, highlighting trends and disparities in the distribution process.

Some regions, particularly those with high concentrations of small businesses, received a larger share of PPP loans. This distribution was influenced by factors such as the number of eligible businesses, the severity of the pandemic's impact on the local economy, and the availability of participating lenders.

Analyzing the regional distribution of PPP loans can help identify areas where the program was most effective and highlight any gaps in coverage. This information is crucial for policymakers seeking to address regional disparities in economic support and ensure that future aid programs are more equitable.

Small Businesses and PPP Loans

Small businesses were the primary focus of the PPP, as they are essential to the U.S. economy and were particularly vulnerable during the pandemic. The PPP loan list of names includes numerous small businesses that benefited from the program, helping them retain employees and sustain operations during challenging times.

The program's emphasis on small businesses was reflected in the eligibility criteria and loan forgiveness provisions. To qualify for full loan forgiveness, businesses had to use a significant portion of the funds for payroll expenses, maintain employee headcount, and adhere to specific timelines for spending the funds.

Despite these efforts, some small businesses faced challenges in accessing PPP loans, particularly those in underserved communities or with limited banking relationships. This highlighted the need for targeted support and outreach to ensure that all eligible small businesses could benefit from the program.

Controversies Surrounding the PPP List

The release of the PPP loan list of names was met with both praise and criticism. While the list provided transparency and accountability, it also sparked controversies regarding the distribution of funds and the eligibility of certain recipients.

One of the main controversies centered around larger companies and well-known brands receiving PPP loans, despite the program's focus on small businesses. This raised questions about the fairness of the allocation process and whether the funds were reaching those most in need.

Additionally, some businesses expressed concerns about privacy and the potential for reputational harm if they were perceived as relying on government aid. These controversies underscore the importance of clear communication and robust oversight in implementing aid programs.

Success Stories from the PPP

Despite the challenges and controversies, the PPP was instrumental in helping numerous businesses survive the pandemic. The PPP loan list of names includes many success stories of businesses that used the funds to retain employees, adapt to changing market conditions, and ultimately thrive.

For example, some businesses in the hospitality and food service sectors used PPP loans to cover payroll expenses, allowing them to keep their doors open and continue serving customers. Others in the healthcare industry used the funds to support frontline workers and maintain essential services during the pandemic.

These success stories highlight the positive impact of the PPP and demonstrate the program's potential to support economic resilience and recovery. By learning from these experiences, policymakers can design more effective aid programs in the future.

Lessons Learned from the PPP

The PPP provided valuable lessons for policymakers and businesses alike. One of the key takeaways is the importance of transparency and accountability in implementing large-scale aid programs. The public release of the PPP loan list of names was a significant step in this direction, but more can be done to enhance oversight and prevent fraud.

Another lesson is the need for targeted support and outreach to ensure that all eligible businesses, particularly those in underserved communities, can access aid. This requires collaboration between government agencies, financial institutions, and community organizations to reach businesses that may face barriers to accessing traditional banking services.

Finally, the PPP underscores the importance of flexibility and adaptability in responding to economic crises. The program's phased implementation and evolving eligibility criteria allowed it to reach a broad range of businesses and address their changing needs. These lessons can inform the development of future aid programs and contribute to more effective responses to economic challenges.

Future of Government Aid Programs

The PPP has set a precedent for future government aid programs, highlighting the importance of timely and targeted support during economic crises. As policymakers consider the future of government assistance, they must balance the need for rapid response with the principles of transparency, accountability, and equity.

One potential area for improvement is the use of technology to streamline the application and distribution process, reducing barriers for businesses seeking aid. Additionally, policymakers must consider the long-term implications of aid programs, such as the potential impact on public finances and the need for sustainable economic growth.

By learning from the experiences and challenges of the PPP, policymakers can design more effective and equitable aid programs that support businesses and promote economic resilience in the face of future challenges.

Impact of the PPP on Employment

The PPP played a crucial role in supporting employment during the pandemic, helping businesses retain workers and avoid layoffs. The program's emphasis on payroll expenses and employee retention was designed to stabilize the labor market and reduce the burden on unemployment insurance systems.

The PPP loan list of names includes many businesses that successfully used the funds to maintain their workforce, contributing to economic stability and recovery. By analyzing employment data among loan recipients, researchers can assess the program's impact on job retention and evaluate its success in achieving its primary objectives.

While the PPP was instrumental in supporting employment, it also highlighted the need for targeted support for specific sectors and regions that faced unique challenges during the pandemic. These insights can inform future policy decisions and help ensure that aid programs effectively address the needs of the labor market.

Economic Recovery and the PPP

The PPP was a key component of the U.S. government's response to the economic challenges posed by the COVID-19 pandemic. By providing financial support to businesses, the program aimed to stabilize the economy and promote recovery.

The impact of the PPP on economic recovery is evident in the data, with many businesses reporting improved financial performance and increased confidence in their ability to navigate future challenges. The program's success in supporting economic resilience underscores the importance of timely and targeted aid during crises.

As the economy continues to recover, policymakers must consider the long-term implications of the PPP and other aid programs, such as their impact on public finances and the need for sustainable growth. By learning from the experiences of the PPP, policymakers can design more effective strategies for promoting economic recovery and resilience in the face of future challenges.

Ethical Considerations in Loan Distribution

The distribution of PPP loans raised several ethical considerations, particularly regarding the fairness and equity of the allocation process. By examining the PPP loan list of names, researchers can assess whether the funds were distributed equitably and whether the program effectively reached those most in need.

One ethical consideration is the potential for disparities in access to PPP loans, particularly among businesses in underserved communities or those with limited banking relationships. Ensuring that all eligible businesses have equal access to aid requires targeted support and outreach efforts.

Another ethical consideration is the need for transparency and accountability in the distribution and use of funds. The public release of the PPP loan list of names was a step in this direction, but more can be done to enhance oversight and prevent fraud.

By addressing these ethical considerations, policymakers can design more equitable and effective aid programs that support businesses and promote economic resilience in the face of future challenges.

Conclusion

The PPP loan list of names provides valuable insights into the impact and effectiveness of the Paycheck Protection Program. By analyzing the data, researchers can assess the program's success in supporting businesses and promoting economic resilience during the COVID-19 pandemic.

The PPP has provided important lessons for future aid programs, highlighting the importance of transparency, accountability, and equity in the distribution of funds. By learning from the experiences and challenges of the PPP, policymakers can design more effective strategies for supporting businesses and promoting economic recovery in the face of future challenges.

As the economy continues to recover, the insights gained from the PPP can inform the development of more targeted and equitable aid programs, ensuring that all businesses have the support they need to thrive in the face of future challenges.

Frequently Asked Questions

1. What is the PPP loan list of names?

The PPP loan list of names is a public record that includes information on the recipients of Paycheck Protection Program loans, including the amount of each loan and the purpose for which the funds were intended.

2. Why was the PPP loan list of names released?

The release of the PPP loan list of names was intended to provide transparency and accountability in the distribution of funds, ensuring that taxpayer dollars were used appropriately and reaching those most in need.

3. How can the PPP loan list of names be used for research?

Researchers can use the PPP loan list of names to analyze trends and patterns in the distribution of loans, assess the program's impact on different industries and regions, and evaluate its success in supporting businesses and promoting economic recovery.

4. What controversies have arisen from the PPP loan list of names?

Controversies surrounding the PPP loan list of names include concerns about the fairness of the allocation process, the eligibility of certain recipients, and privacy issues for businesses that received government aid.

5. How has the PPP impacted employment?

The PPP played a crucial role in supporting employment during the pandemic by helping businesses retain workers and avoid layoffs. The program's emphasis on payroll expenses and employee retention contributed to economic stability and recovery.

6. What lessons have been learned from the PPP?

Lessons from the PPP include the importance of transparency and accountability in aid programs, the need for targeted support and outreach, and the value of flexibility and adaptability in responding to economic crises.

For more detailed insights and data analysis, visit the official site of the U.S. Small Business Administration at SBA.gov.

You Might Also Like

The Life And Success Of George Santo Pietro: A Multifaceted JourneyRocco Kevin Marchegiano: The Illustrious Life And Legacy

Barna Barsi: The Cultural Significance And Celebration

Ultimate Guide To The Obama Wedding Party Extravaganza

Frankie Katafias Husband: A Closer Look Into Their Relationship

Article Recommendations