Bob Ross's financial situation at the time of his death remains a matter of public interest. Determining his net worth requires careful consideration of his income streams, expenses, and assets during his career. Factors such as potential investments, tax implications, and other financial considerations contribute to the overall assessment.

Understanding Bob Ross's financial standing at the time of his passing provides insight into the career trajectory of a highly recognizable personality in American popular culture. While the exact amount is not always publicly accessible, such information can illuminate aspects of his career earnings and personal life. A thorough analysis can contribute to a better understanding of the economic realities and opportunities available to individuals in creative fields during the period in which he worked. This is important both historically and for anyone pursuing a similar path.

This exploration of financial data forms a critical piece of the larger narrative surrounding Bob Ross's life and legacy. Further research into details surrounding his estate and financial dealings will be relevant to a more complete understanding. Exploring this aspect will offer context for the discussion of his impact on popular culture and art instruction.

How Much Was Bob Ross Worth When He Died?

Determining Bob Ross's net worth at the time of his death necessitates exploring various financial factors. The precise figure remains somewhat elusive, yet understanding these factors offers insights into his career and financial circumstances.

- Income sources

- Investment strategies

- Tax implications

- Estate details

- Public perception

- Television career

- Personal expenses

- Appreciation value

Understanding Ross's income sources, such as his television show, combined with his investment strategies and personal expenses, provides crucial context for determining his worth. Tax implications and estate details influence the reported figure, which may vary depending on the source. The public's perception of his value, alongside the appreciation value of his art and memorabilia, contribute to the overall picture. Ross's television career undoubtedly played a significant role in his financial trajectory. Analysis of these aspects unveils a multifaceted narrative about the financial realities of a creative professional.

1. Income Sources

Bob Ross's income derived primarily from his television show, The Joy of Painting. Royalties from this program likely constituted a significant portion of his earnings. Additional income could have stemmed from merchandise sales, book royalties, and potential investments in the years prior to his death. The value of these various sourcesand their combined influence on his overall worthmust be carefully considered when trying to ascertain his net worth.

Analyzing the financial structure and specifics of these income streams is crucial in understanding the overall picture. The show's popularity and subsequent merchandise sales, like paint sets and books, created a sustainable stream of revenue. The volume of sales and profitability would play a pivotal role in determining his worth. The extent to which Ross diversified his income through investments would also have a significant impact, potentially compounding his assets over time. Illustrative examples from other artists, whose income is similarly tied to multiple avenues like art sales and merchandise, can provide supporting data points.

In conclusion, understanding the multifaceted nature of Bob Ross's income sources is paramount to grasping the financial picture of his life. A comprehensive analysis of these sources, including television royalties, product sales, and potential investment income, is essential to approximate his net worth at the time of his death. This understanding is beneficial for contextualizing his success and legacy within the broader artistic community.

2. Investment Strategies

Investment strategies employed by Bob Ross, if any, directly influenced his net worth at the time of his death. Investment decisions, such as the allocation of capital to stocks, bonds, real estate, or other assets, played a crucial role in accumulating wealth. The success or failure of these strategies significantly impacted the overall value of his holdings. The timing of investment choices and the prevailing market conditions during his career were critical factors. The return on investment, or lack thereof, on any investments he made was a component of his overall financial situation.

Without detailed knowledge of Ross's specific investment portfolio, it's difficult to quantify the precise impact of his strategies on his final net worth. However, it's essential to recognize that successful investment strategies often involve risk assessment, diversification, and a long-term perspective. The impact of these strategies on his wealth is linked to the financial returns generated during his lifetime. Understanding the general principles of investment strategies is crucial when attempting to assess the financial standing of individuals who pursued or had opportunities for financial expansion.

The absence of public information concerning Bob Ross's specific investment strategies does not diminish their importance as a component of calculating his overall net worth. The study of investment strategies reveals how financial decisions, regardless of the specifics, contribute to an individual's wealth accumulation. This knowledge is valuable for anyone seeking to understand wealth creation, particularly in creative fields where income diversification may be important. The lack of concrete information on Ross's investments underscores the challenges in precisely determining his net worth and the limitations of incomplete data in financial analysis.

3. Tax Implications

Tax implications significantly influence the final calculation of an individual's net worth. Understanding the tax liabilities associated with Bob Ross's income and assets at the time of his death is crucial for a complete picture of his financial situation. Tax laws and regulations, varying over time and across jurisdictions, directly impact the amount of assets available to heirs. The evaluation must consider any tax deductions or credits that might have affected the final figure.

- Income Tax Liability:

Income generated from various sources, including television appearances, merchandise sales, and potential investments, were subject to income tax. The specific rates and brackets applicable during the period in which Ross was active are relevant. Calculating the amount of income tax paid or owed on his earnings is necessary for determining the actual income available after taxes. For instance, high-income earners often have progressively higher tax rates. This impacts the net worth figure directly.

- Estate Taxes:

Upon Bob Ross's death, any remaining assets were subject to estate taxes, depending on applicable regulations and the value of his estate. Understanding these tax liabilities is vital to determining the actual net worth available to his heirs. The tax burden was contingent on the estate's total value and relevant tax codes. This amount reduces the overall net worth of the estate.

- Capital Gains Taxes:

If Ross had investments, any capital gains resulting from the sale of those investments were subject to capital gains taxes. These taxes impact the ultimate value of the estate by reducing the amount of funds that are transferred. The specifics of how such gains would be taxed at the time are crucial to the accurate valuation.

- Gift Taxes (if applicable):

If Bob Ross had made any significant gifts during his lifetime, this would affect his estate's net worth and might have triggered gift tax obligations. Understanding how this applies to the situation, based on historical tax rules, is essential to complete the valuation accurately. The calculation would take into account the amount of these gifts.

Careful consideration of these tax implications provides a more realistic and accurate estimation of Bob Ross's actual net worth at the time of his death. The amounts paid in taxes reduce the total value available to beneficiaries and must be factored into any calculations used to understand his overall financial position. Comparative analysis with similar individuals who earned comparable incomes can help illuminate how these tax obligations influenced Bob Ross's personal financial position.

4. Estate details

Estate details are inextricably linked to determining Bob Ross's net worth at the time of his death. The manner in which his assets were distributed, the liabilities associated with his estate, and the legal processes surrounding the transfer of property all contribute to the final financial picture. A thorough examination of these details is necessary to understand the actual value realized after accounting for all related expenses, debts, and taxes.

- Asset Inventory:

A comprehensive list of Bob Ross's assetsincluding bank accounts, investments, real estate, and personal propertyis essential. The value of each asset at the time of his death directly impacts the overall net worth calculation. For instance, if significant real estate holdings existed, their assessed market value on the date of his death would be factored in. Inventorying these assets provides a fundamental basis for establishing the total estate value.

- Debts and Liabilities:

Outstanding debts, such as mortgages, loans, or outstanding tax obligations, must be deducted from the total asset value. These liabilities represent financial obligations that reduce the net worth of the estate. Failure to account for these debts would overestimate the final net worth. The exact amount of any debt must be accurately determined.

- Legal and Administrative Costs:

The legal and administrative costs associated with probate, estate administration, and any required legal proceedings related to the transfer of assets reduce the distributable estate. These costs, including attorney fees, court costs, and executor fees, are subtracted from the gross value of the estate. The efficiency of the estate administration process can affect the amount of the final net worth.

- Distribution of Assets:

The manner in which the estate was distributed among beneficiaries provides further context. Understanding the terms of the will and how specific assets were divided among heirs allows for a more complete financial picture. The specific beneficiaries and their shares of the estate are crucial components in assessing the final value.

Careful consideration of estate details provides a precise accounting of Bob Ross's financial standing after all debts, taxes, and administrative costs are subtracted. The resulting figure, often significantly lower than the initial asset value, reflects the true net worth that was ultimately available for distribution to beneficiaries. By examining these elements, one can gain a more accurate and comprehensive view of his overall financial situation at the time of his passing. This detailed approach is essential for any attempt to understand his financial legacy.

5. Public Perception

Public perception of Bob Ross's value, while not a direct financial metric, significantly influenced the perceived worth of his estate. Public adulation, generating high demand for his artwork, merchandise, and related materials, contributed to the overall value attributed to his legacy. This "brand value" or "iconic status" can indirectly impact the perceived worth of his assets, including potentially influencing the price realized in estate sales, even if such market valuations do not directly factor into a traditional net worth calculation. For instance, popular figures with considerable brand recognition often see their possessions command premium prices in auctions compared to similar items from individuals lacking comparable public appeal.

The strong public interest in Ross's life and work likely influenced how his estate was managed and valued. The heightened demand for Bob Ross-related merchandise could have driven up the prices of items related to his estate, like original paintings, tools, or personal effects. Auction houses and collectors might have factored this public demand into their assessments, potentially leading to higher sale prices for some items within the estate. This phenomenon can be seen in the valuation of other deceased celebrities' possessions; a strong public following often translates into increased value of related items.

Conversely, a lack of public interest or a negative perception of Ross might have resulted in lower valuations for related assets. Public opinion, therefore, played a pivotal, albeit indirect, role in shaping the perceived value assigned to his estate. Understanding this connection is important in recognizing the intangible factors that can influence the value attributed to a person's legacy beyond their tangible assets. While public perception doesn't directly determine a financial figure, it does contribute to the overall estimation and narrative surrounding the estate's worth and value.

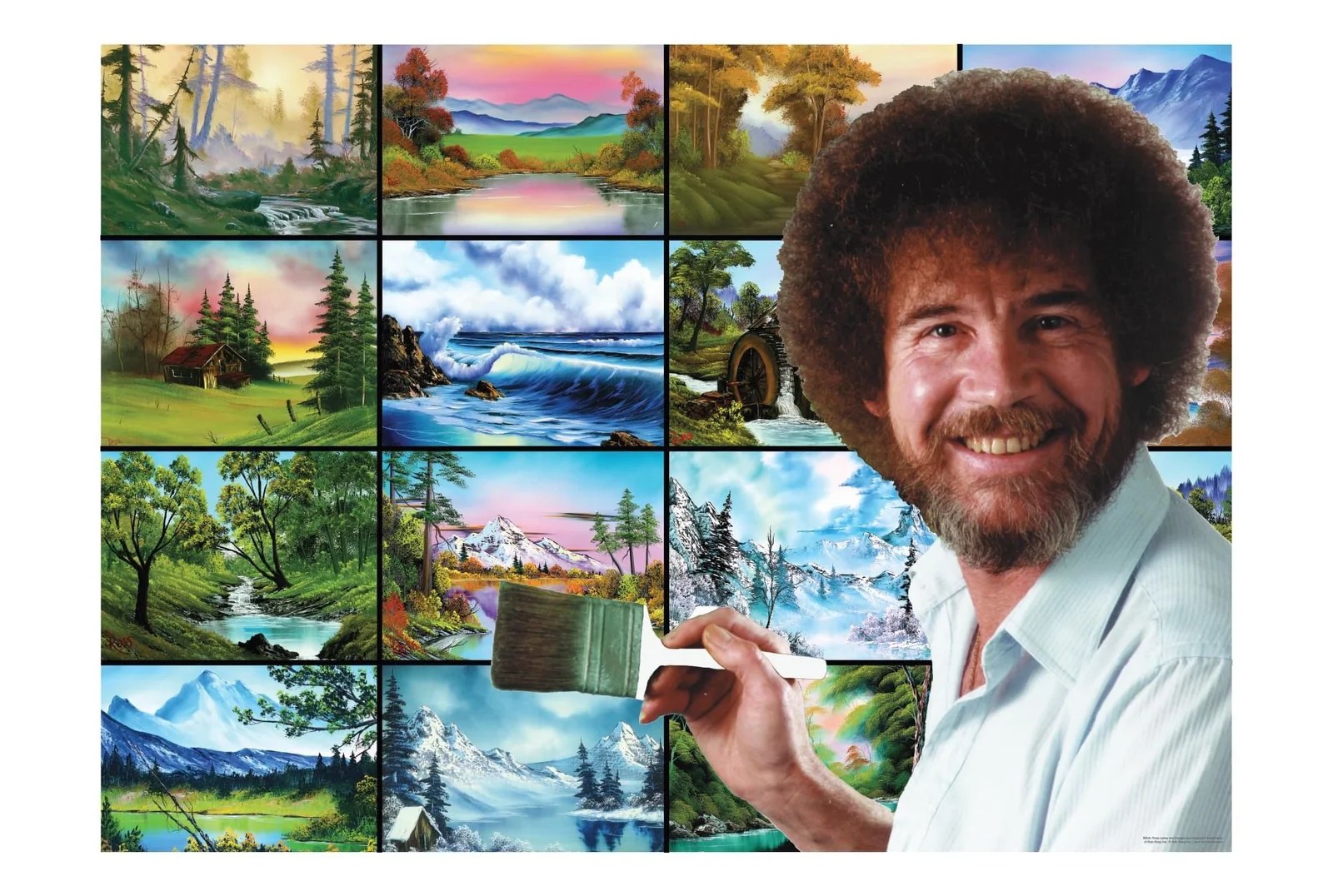

6. Television Career

Bob Ross's television career, specifically The Joy of Painting, was a pivotal factor in determining his financial standing at the time of his death. The show's popularity and enduring appeal directly impacted his income and consequently, his overall net worth. Examining the relationship between his television work and his financial situation provides crucial context.

- Recurring Income Streams:

The Joy of Painting generated substantial recurring revenue through various income streams. Television royalties, a significant portion of his income, stemmed from the show's continued syndication and reruns. This consistent source of income built a foundation for his financial security. The revenue generated from these various streams accumulated over time, directly contributing to the total assets in his estate. This established a consistent, reliable income, which contrasts with other income sources that may not have been as sustained.

- Merchandise Sales:

The show's success fueled a demand for merchandise, including paint sets, books, and other related items. These sales contributed substantially to his income and expanded his brand's reach. The revenue from merchandise created a secondary income stream supplementing his television royalties. The volume of merchandise sales directly correlated with the show's popularity and would have been a key factor in estimating the overall income associated with his career.

- Brand Value and Residual Income:

The Joy of Painting established a strong brand identity for Bob Ross. This brand value continued even after his death, creating residual income streams. The enduring popularity of the show, even decades after its initial run, translated into continued sales of related products. This legacy created an asset not directly tied to a particular time frame or specific income period, but rather an overall impact on the value attributed to his work.

- Impact on Estate Valuation:

The extensive income generated from his television career, alongside the ongoing value of his brand, significantly increased the overall valuation of his estate. This influence must be considered when trying to ascertain his net worth. Factors such as merchandise sales and enduring brand value must be factored into the estimate of his financial situation. The financial impact was a key contributor to the overall valuation of his estate.

In conclusion, Bob Ross's television career, particularly The Joy of Painting, was instrumental in shaping his financial trajectory and the subsequent valuation of his estate. The show's continued popularity, merchandise sales, and enduring brand value created multiple revenue streams that directly contributed to his substantial worth at the time of his death.

7. Personal Expenses

Evaluating Bob Ross's personal expenses is essential for accurately determining his net worth at the time of his death. Understanding the amount and nature of these expenses is crucial; they directly reduce the overall value of his estate. The difference between his total assets and his personal expenditures represents the true financial picture available to beneficiaries.

- Living Expenses:

Daily living expenses, including housing, food, utilities, and transportation, significantly reduce the net worth of an individual. Detailed records of Ross's living costs in the period leading up to his death are necessary. These expenses, similar to those of other individuals of comparable income levels during the time period, provide vital context. A comparison of average living expenses with the known aspects of his lifestyle and income could shed light on the amount of his personal consumption. For example, the cost of owning or renting a home, including utilities and repairs, directly impacts the amount of money available for other expenses and investments. Expenses related to entertainment and leisure pursuits, while not strictly necessary, would also be factors in the equation.

- Healthcare Costs:

Medical expenses, including routine care and potential illness-related costs, directly reduce net worth. Analyzing the financial impact of healthcare expenditures on Ross's estate is vital. The availability of health insurance or other forms of financial protection would influence the actual amount of funds spent on these accounts. Similar to the calculation of other lifestyle costs, quantifying these expenses is necessary to get a comprehensive idea of the amount of money spent on his general well-being. Expenses could include doctor visits, prescription drugs, or long-term care. Detailed analysis can help estimate the amount of income diverted toward healthcare compared to other areas.

- Investment Management Fees and Costs:

Expenses related to investment management, such as fees for financial advisors or investment management services, represent a deduction from the overall net worth. Understanding any investment strategies Ross used and the associated expenses will be essential. Expenses related to brokerage fees, account management fees, or tax preparation for investments are subtracted. This analysis helps to assess the level of financial expertise Ross may have employed and the efficiency of his investment strategies. A comparison with industry benchmarks could indicate whether Rosss expenses were in line with market standards.

- Debt Repayment:

Outstanding debts, such as loans or mortgages, must be included in the calculation of personal expenses. These obligations directly affect the net worth. Any outstanding loans, credit card debt, or other financial commitments at the time of his death represent subtractions from the total worth. Identifying the type and amount of debt helps understand the financial responsibilities factored into his overall financial picture. This includes credit card debt, personal loans, and any mortgages or lines of credit.

In conclusion, examining Bob Ross's personal expenses provides essential context for understanding his financial situation. By meticulously evaluating these expenses, a more accurate assessment of his net worth at the time of his death can be obtained. Reconciling the factors discussed here will illuminate how his income was allocated and utilized. This approach acknowledges the significant influence of lifestyle choices on an individual's financial standing.

8. Appreciation Value

The appreciation value of Bob Ross's artwork and associated memorabilia plays a crucial role in determining his overall worth at the time of his death, although it's not directly reflected in a traditional net worth calculation. Appreciation value represents the increase in the market value of an asset over time, often driven by factors like scarcity, demand, and the perceived artistic merit. In Ross's case, the growing popularity of his work and his distinctive style have contributed to this. Items considered part of his estate, like original paintings, tools, or personal effects, potentially saw a significant rise in value, beyond the original acquisition price or initial market estimation.

The appreciation value of an asset is not static but rather dynamic, reflecting market trends. A popular artist like Bob Ross, whose work garners increasing demand over time, benefits from this inherent appreciation. This phenomenon isn't unique to Ross; the value of historical works of art and collectibles often increases exponentially based on factors such as rarity and historical significance. Collectors and auction houses may adjust their valuations of his items based on their perceived rarity, quality, and connection to the artist's legacy. Therefore, a precise calculation of his overall worth needs to consider the potential increase in value of these assets. The importance of this factor is further accentuated by the fact that it's not just about the original paintings but any associated items connected to his work, which are all subject to increasing appreciation based on their relationship to his iconic persona.

Understanding the role of appreciation value in determining an artist's overall worth provides a more complete picture. It highlights the intangible elements contributing to an individual's legacy, going beyond simply calculating the sum of assets. This crucial element of valuation, frequently neglected in traditional financial calculations, underscores the complexity of determining the worth of someone whose influence extends beyond tangible items. While the exact calculation of this increase in value remains complex, recognizing its presence is essential to a complete understanding of the impact Bob Ross had on the art world and the market value of his contributions. This crucial factor allows a richer understanding of the interplay between artistic merit, market demand, and overall valuation.

Frequently Asked Questions

This section addresses common inquiries regarding Bob Ross's financial situation at the time of his death. Accurate determination of his net worth requires careful consideration of various factors, including income, expenses, investments, and tax implications.

Question 1: What was Bob Ross's exact net worth at the time of his death?

Precise figures for Bob Ross's net worth at the time of his death remain elusive. Publicly available data is limited. The complexities of calculating net worth include determining the exact value of assets, accounting for debts and taxes, and assessing the inherent valuation of intangible aspects of his legacy. Determining an exact figure relies on potentially incomplete records and confidential estate details.

Question 2: What were Bob Ross's primary sources of income?

Bob Ross's primary income stemmed from The Joy of Painting. Royalties from the show's syndication and reruns, along with merchandise sales (paint sets, books, etc.), constituted significant portions of his earnings. Potential investments, though not fully documented, likely supplemented these major income streams.

Question 3: Were there any significant debts or liabilities in his estate?

Understanding Bob Ross's financial situation requires considering any outstanding debts. While precise details remain private, it's likely that, similar to most individuals, he had various financial obligations. Determining the precise amount of any debts requires access to confidential estate records.

Question 4: How did tax implications affect his net worth?

Tax obligations directly impact the amount of funds available to beneficiaries after death. Various taxes, such as income tax on his earnings and estate tax on the value of his assets, reduced the overall net worth available. The specific tax rates and regulations applicable at the time of his death are critical factors.

Question 5: Did the public's perception of Bob Ross affect his estate's valuation?

The public's high regard for Bob Ross and his work likely impacted the perceived value of his estate, even if not directly reflected in formal financial statements. The demand for related merchandise and memorabilia may have influenced the valuation of assets. The intangible aspect of his brand value would be factored into a broader consideration of his worth.

Question 6: What role did investments play in his overall financial situation?

Limited publicly available information prevents a conclusive assessment of Bob Ross's investment activities. Unveiling any investment strategies and their returns is essential to fully understand his financial situation. The specific nature and success of any investment strategies are unavailable without further analysis. Lack of information on this front makes determining any possible impact difficult.

In summary, determining Bob Ross's precise net worth at the time of his death necessitates a comprehensive approach considering various financial factors. The absence of detailed records and the complexity of valuation processes make an exact figure difficult to ascertain. The limited public information emphasizes the challenges in accurately determining the financial status of individuals in creative fields.

Moving forward, further research into available records, such as those accessible through the probate process, might provide additional insight into his financial situation.

Tips for Understanding Bob Ross's Financial Situation

Determining Bob Ross's net worth at the time of his death is a complex undertaking. Publicly available information is limited, and the specific details of his financial affairs remain largely private. These tips provide a framework for understanding the factors that contributed to his overall financial situation.

Tip 1: Focus on Income Streams. Bob Ross's primary income derived from The Joy of Painting. This encompassed television royalties, merchandise sales (paint sets, books, etc.), and potential investment returns. Analyzing these diverse income sources helps to establish a more complete picture of his earnings.

Tip 2: Account for Expenses. Living expenses, including housing, healthcare, and personal expenditures, are crucial to consider. These expenses directly reduced the amount of funds available to Bob Ross or his estate after accounting for other liabilities. Subtracting these costs from the total income reveals a clearer understanding of the final financial standing.

Tip 3: Examine Investment Strategies. Investment activities played a role in accumulating wealth and shaping his financial position. Identifying and evaluating any documented investment strategies (e.g., stocks, bonds, real estate) reveals the potential impact on his overall assets. It is essential to consider the potential returns on any investments and the associated costs of management.

Tip 4: Analyze Tax Implications. Tax laws and regulations directly impact the financial outcome for an individual and their estate. Income tax, estate tax, and potential capital gains taxes, all influenced his overall financial situation. A thorough examination of tax records (if available) reveals how these deductions affected the net worth of his estate.

Tip 5: Consider Estate Details. The distribution of assets, liabilities, and legal costs associated with the estate are crucial. Details about assets (bank accounts, real estate, personal property), debts, and probate costs will provide a precise picture of his remaining assets after legal obligations have been met. Understanding the distribution of assets among beneficiaries, as outlined in a will, helps determine the financial resources available to them.

Tip 6: Evaluate Brand Value. Bob Ross's significant public recognition and the enduring appeal of his work are factors influencing the perceived and potential market value of his assets. The influence of his brand and the demand for related merchandise would likely have increased the overall valuation of his estate.

Tip 7: Consult Public Records (Where Available). While complete and detailed records are often private, consulting publicly accessible records (such as probate documents, if available) provides valuable insights into assets, debts, and distributions.

Following these tips offers a more comprehensive approach to evaluating Bob Ross's financial situation. Understanding these factors contributes to a more nuanced comprehension of his financial standing at the time of his death. A complete analysis of his financial affairs requires careful consideration of the interplay between these various components.

Further research, particularly the examination of available documentation, may offer more specific and detailed insights into Bob Ross's overall financial situation. This detailed approach offers greater clarity in understanding the many factors that shaped his financial trajectory and legacy.

Conclusion

Determining Bob Ross's precise net worth at the time of his death remains challenging due to limited public access to detailed financial records. While the popularity of The Joy of Painting and the subsequent demand for related merchandise generated substantial income, the extent of his investments and personal expenses are not fully documented. Factors such as tax implications, estate administration costs, and the indirect impact of his brand recognition on asset valuation complicate a straightforward calculation. Ultimately, the true picture of his financial situation requires a more complete understanding of his income streams, investment strategies, and personal expenditures, all of which were not fully documented in public records.

The exploration of Bob Ross's financial standing underscores the complexities of evaluating an individual's wealth, particularly within creative fields. The enduring appeal of his art and television work contributed to a significant, though possibly underestimated, legacy. Further research into available records, such as estate documents, could potentially shed light on the financial details of his life. This would contribute to a fuller understanding of the economic realities faced by artists and creative professionals during his era, offering insights for future generations pursuing similar paths. This information would provide greater clarity regarding the financial aspects of a career often characterized by intangible and fluctuating asset values, thereby improving the accuracy of future valuations in similar contexts.

You Might Also Like

Narcos Season 3 Episode Count: Complete GuideJean-Claude: The Latest News & Insights

Uncommon National Geographic Magazines: Rare Finds & Collector's Items

Kim Kardashian Brands: Top Must-Have Products & Collections

US Penny Discontinued? Find Out Why!

Article Recommendations