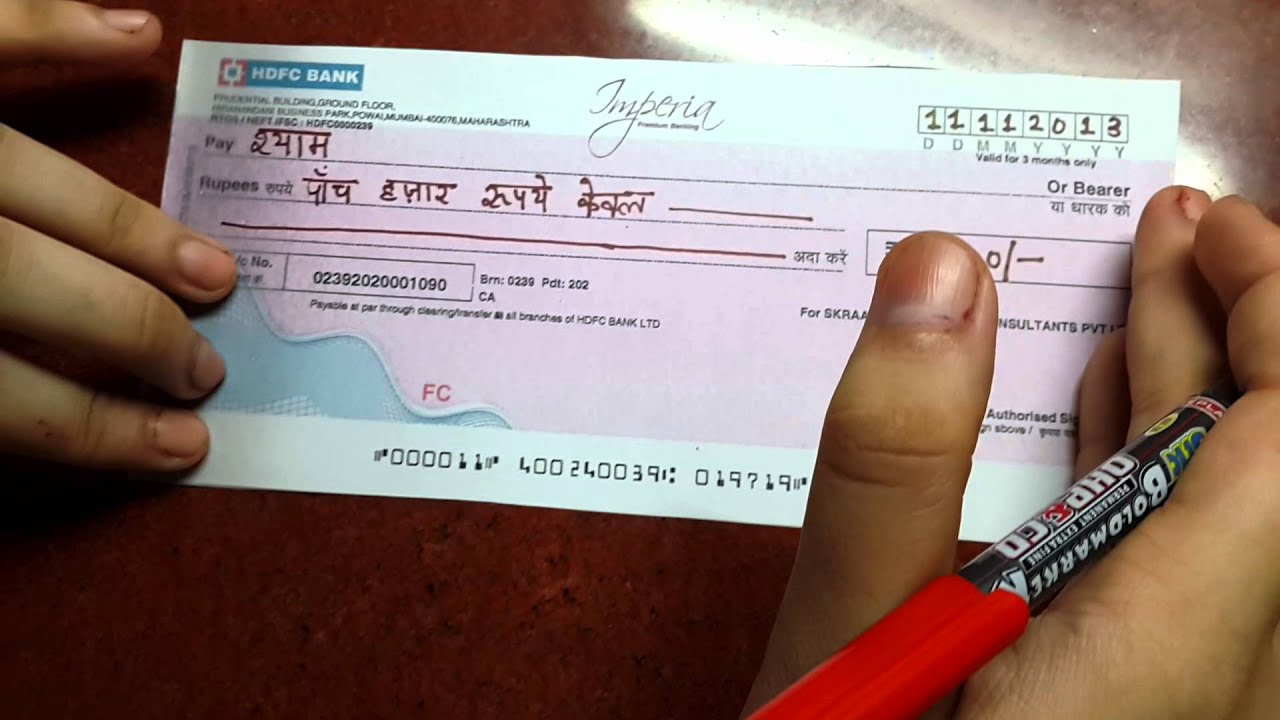

A process involving the presentation of a negotiable instrument, such as a check or promissory note, to a party for payment on two separate occasions. This dual presentation can occur under circumstances where the initial attempt fails or is deemed insufficient. For example, a check might be presented to a bank for payment, but due to insufficient funds, payment is refused. A subsequent presentation, after corrective action has been taken, might be successful. This process is critical to ensuring the proper handling and resolution of such financial instruments.

The practice of presenting a claim twice holds significance in upholding the integrity of financial transactions. It allows for the verification of conditions and corrections in a timely manner, preventing potential disputes and delays in settlements. This approach establishes a robust procedure for addressing payment failures and provides a clear path for both parties involved. A second presentation offers a mechanism to recoup from setbacks by addressing the root cause of the initial failure. In certain legal contexts, this procedure may be mandated to ensure the validity of transactions.

Understanding this procedure of multiple presentations is crucial for navigating the complexities of financial instruments. The procedures for handling this process vary according to the instrument's type and jurisdiction. This article will explore how these mechanisms are employed in various financial sectors, illustrating their impact on different types of transactions, including commercial, government, and consumer-facing interactions.

Double Presentment

Understanding the process of double presentment is vital for ensuring the validity and efficiency of financial transactions. This process involves a crucial sequence of actions, encompassing the re-presentation of a claim. This procedure has implications for various sectors, from commerce to finance.

- Negotiable Instruments

- Payment Failures

- Corrective Action

- Second Attempt

- Transaction Resolution

- Legal Implications

- Claim Validation

- Financial Integrity

These aspects highlight the multifaceted nature of double presentment. For example, a failed payment of a check (negotiable instrument) necessitates corrective action (e.g., replenishing funds). The second attempt (presentment) verifies the corrected issue, ensuring the transaction is resolved. The process's legal implications dictate the required steps for different transactions, like issuing checks, and guarantee financial integrity in cases of discrepancies. This comprehensive procedure underscores the reliability of financial systems and maintains a balance between potential errors and secure payment.

1. Negotiable Instruments

Negotiable instruments are financial documents embodying a right to payment. Their transferability, often through endorsement, underpins the process of double presentment. This connection arises from potential payment failures, prompting a second attempt at collection. The specific procedures surrounding the treatment of these instruments during double presentment are crucial to maintaining the integrity and efficiency of financial transactions. Understanding the nature of negotiable instruments is essential for comprehending the necessity and application of double presentment procedures.

- Transferability and Endorsement

The transferability inherent in negotiable instruments forms a crucial link to double presentment. Checks, for instance, can be endorsed to a new party. If initial payment is refused, this transferred ownership allows for a second presentation. This feature underscores the flexibility of these instruments and their suitability for various payment scenarios.

- Payment Failure and Corrective Action

A significant aspect of double presentment involves the interplay between a negotiable instrument and a failure of the initial payment. When a check bounces due to insufficient funds, the holder is empowered to pursue corrective action (such as replenishing funds) to rectify the situation. This is where double presentment comes into play, enabling the re-submission of the instrument for payment.

- Legal Framework and Validation

The legal framework surrounding negotiable instruments is crucial in defining the steps and timelines involved in double presentment. Laws governing these instruments often specify the procedures for re-presentation, impacting the validity of the second attempt and ensuring a reliable mechanism for resolution. The validity of such transactions hinges on adherence to these procedures.

- Commercial and Financial Applications

Negotiable instruments, like promissory notes, are commonplace in commercial transactions. Double presentment procedures become significant when payments are not honored. This is applicable not only in large-scale commerce but also in smaller financial transactions, creating a framework for resolving disagreements and facilitating financial interactions. These facets contribute to a comprehensive system designed for smooth financial transactions.

In summary, negotiable instruments are central to the concept of double presentment. Their inherent features transferability, treatment upon failure, and legal underpinnings directly influence the procedures for a second attempt at payment. Understanding these instruments and the related legal framework is key to recognizing the importance of double presentment as a crucial aspect of financial processes, especially those involving payment transactions.

2. Payment Failures

Payment failures are an intrinsic component of financial transactions. They represent instances where a party obligated to make a payment is unable or unwilling to do so. These failures can stem from various causes, including insufficient funds, errors in processing, or disputes over the validity of the transaction. The occurrence of payment failures necessitates a robust system for handling such situations. This is where the process of double presentment assumes critical importance. A second presentation, after appropriate corrective action, provides a means of resolving the initial failure.

Consider a scenario where a check is issued for payment but subsequently bounces due to insufficient funds. This represents a payment failure. Without a mechanism for addressing such failures, the transaction remains unresolved, potentially leading to disputes and financial instability. Double presentment, in this context, offers a pathway for resolution. Once the underlying cause of the failure (e.g., insufficient funds) is rectified, a second attempt to collect payment can be made, potentially restoring the integrity of the financial transaction. This process applies to various contexts, such as commercial transactions, government payments, and consumer transactions, highlighting its widespread practical application.

The significance of understanding the connection between payment failures and double presentment lies in its practical application. Understanding the process allows parties involved in a transaction to anticipate potential failures and plan for corrective action. It also clarifies the procedures required for a successful second presentation, reducing uncertainty and potential conflict. By establishing clear protocols for addressing payment failures, a robust and reliable system for handling financial obligations is maintained, minimizing disruptions and fostering trust in financial dealings. This, ultimately, contributes to the stability and smooth functioning of financial systems.

3. Corrective Action

Corrective action is a crucial component of double presentment, acting as the bridge between a failed initial presentation and a successful second attempt. It involves addressing the specific reason for the initial payment failure. The efficacy of the double presentment process hinges on the nature and effectiveness of the corrective action undertaken.

- Identifying the Root Cause

Determining the precise cause of the payment failure is paramount. Was it insufficient funds, a processing error, a dispute over the underlying transaction, or something else entirely? Pinpointing the root cause enables targeted and effective corrective action, ensuring that the second attempt at payment is not thwarted by the same issue. A lack of thorough investigation can lead to the same failure recurring during the second presentation.

- Implementing Remedial Measures

Once the root cause is identified, appropriate remedial measures must be implemented. This might involve replenishing funds, correcting data entry errors, resolving disputes, or clarifying ambiguities in the transaction. The specific corrective action should directly address the cause of the initial failure. The effectiveness of the corrective measures directly impacts the likelihood of successful payment during the second presentation.

- Timeliness and Efficiency

The swiftness and efficiency of implementing corrective action significantly influences the overall success of the double presentment process. Delays in addressing the payment failure may result in the second attempt being unsuccessful or encountering further complications. A timely resolution minimizes disruptions and enhances the reliability of financial transactions. The prompt nature of corrective actions affects the financial health of participants involved and demonstrates the system's efficacy.

- Documentation and Record-Keeping

Thorough documentation of the corrective action taken is essential. Records should detail the nature of the failure, the steps taken to rectify it, and the result of the corrective action. This documentation serves as a crucial reference point for both parties involved and, importantly, acts as evidence in case of future disputes. Clear records minimize ambiguities and strengthen the validity of the entire double presentment process.

In summary, corrective action acts as the cornerstone of the double presentment process. By thoroughly identifying the root cause, implementing appropriate remedial measures, ensuring timeliness, and maintaining accurate documentation, the process can effectively address payment failures and maintain the integrity of financial transactions. The efficacy of the corrective action taken directly correlates with the success of the second attempt, illustrating the interconnectedness of these aspects in the broader context of secure and reliable financial systems.

4. Second Attempt

A "second attempt" is a critical element in the process of double presentment, particularly in situations involving negotiable instruments like checks or promissory notes. It represents a follow-up action taken after an initial attempt at payment fails. The efficacy of the "second attempt" hinges on the nature of the initial failure and the subsequent corrective action. A successful "second attempt" ultimately resolves the payment issue, maintaining the integrity of the financial transaction.

The importance of the "second attempt" as part of double presentment stems from its ability to address payment failures. Without a second chance, financial transactions could become protracted, potentially leading to disputes, delays, and disruption in business operations. A real-world example involves a business receiving a check that bounces. The business can take corrective action, such as verifying sufficient funds with the payer, before initiating a second attempt at presentment. A successful second attempt ensures the transaction is finalized and the business receives payment, preventing financial hardship and maintaining smooth operations. Similar scenarios exist in government transactions, where timely payment is vital for project execution, and consumer-facing interactions, where a second attempt can safeguard the rights of the recipient.

Understanding the interplay between the "second attempt" and double presentment is essential for maintaining financial stability and efficiency. This understanding allows participants in financial transactions to anticipate potential failures and devise strategies for resolving them. It clarifies the procedures for a successful second presentation, thereby reducing uncertainty and potentially minimizing conflicts. By establishing clear protocols surrounding the "second attempt," the system can effectively manage payment failures and guarantee the reliability of financial instruments. The practical significance is apparent in various contexts, from commercial transactions to government processes, fostering a more robust and dependable financial framework.

5. Transaction Resolution

Transaction resolution is inextricably linked to double presentment. Double presentment, in essence, provides a structured approach to resolving transactions that encounter initial payment failures. The process necessitates a clear pathway for rectifying the initial failure, ensuring the transaction concludes with a definitive outcome. A successful transaction resolution, achieved through the second presentation, upholds the validity and integrity of financial instruments. Without a defined resolution process, disputes and ambiguity may arise, potentially disrupting the efficient flow of financial transactions. Consider a business receiving a check that bounces. The corrective action, like verifying sufficient funds, and the subsequent second presentment are critical steps toward transaction resolution. This approach is vital for maintaining trust and stability within financial systems.

The importance of transaction resolution within the context of double presentment extends beyond simple payment. It encompasses the entire cycle of the transaction. For example, if a contract is contingent on receiving a payment, resolution becomes essential to establishing contract fulfillment. A second attempt, successfully resolving the payment issue, triggers the subsequent steps. Without this resolution, the contract might remain in a state of limbo, impacting the contractual obligations and the financial position of the involved parties. This applies not only in business-to-business transactions but also in consumer-facing interactions, where the rapid and certain resolution of payment issues is essential for customer satisfaction and trust. The resolution process, therefore, is critical for smooth business operations and consumer confidence in the financial system.

Understanding the interplay between transaction resolution and double presentment is crucial for navigating the complexities of modern financial transactions. This understanding ensures the reliable functioning of financial systems, preventing disputes and delays. By adhering to clear and established procedures for handling payment failures and subsequent resolution, the integrity of financial instruments is preserved, thereby enhancing the efficiency and trust associated with financial dealings. Failure to recognize the importance of structured transaction resolution, as a component of double presentment, may lead to uncertainty, disputes, and potential damage to the financial stability of participants. This detailed understanding supports more secure and efficient financial exchanges.

6. Legal Implications

Legal implications associated with double presentment are significant, directly influencing the validity and enforceability of financial transactions. The procedures surrounding this process are often defined by specific laws and regulations, ensuring fairness and predictability in the resolution of payment failures. Understanding these implications is crucial for all parties involved to navigate potential disputes and ensure compliance.

- Statutes and Regulations

Various jurisdictions possess specific statutes and regulations governing negotiable instruments and payment processes. These laws dictate procedures for handling payment failures, including the conditions under which a second presentment is permissible. Compliance with these regulations is critical to avoid legal challenges or invalidating the transaction. Differences in these legal frameworks across jurisdictions necessitate careful consideration for parties involved in cross-border transactions.

- Time Limits and Deadlines

Legal frameworks frequently incorporate time limits or deadlines for initiating corrective action and making a second presentment. Failure to adhere to these timelines may result in the loss of legal recourse for the party seeking payment. Understanding these limitations prevents missed opportunities for resolving payment failures and maintains the validity of the transaction. Specific timeframes can vary based on the type of instrument and the jurisdiction.

- Dispute Resolution Mechanisms

Legal frameworks typically provide avenues for resolving disputes arising from payment failures. Double presentment, when conducted correctly, can strengthen the position of a party seeking payment. However, the failure to follow proper procedures may hinder the effectiveness of the resolution process. Knowing the available avenues for dispute resolution is crucial for navigating potential conflicts and ensuring a fair outcome. The mechanisms can range from mediation to formal litigation.

- Liability and Responsibility

Understanding the allocation of liability and responsibility during the double presentment process is essential. This aspect clarifies who bears the burden of proof and the actions required to sustain a claim. Properly documented procedures, including corrective action and communication, contribute to clarifying liability. Legal precedents often define how courts address cases involving double presentment, influencing the approach to handling future instances.

In conclusion, the legal implications of double presentment are deeply intertwined with the entire process. Navigating these implications requires a thorough understanding of applicable laws, regulations, and dispute resolution mechanisms. Understanding time limits, liability, and dispute resolution procedures is crucial for ensuring a successful outcome for all parties involved in transactions. This knowledge contributes to the stability and effectiveness of the financial system by providing a framework for addressing payment failures and upholding the validity of financial instruments.

7. Claim Validation

Claim validation is a critical component of double presentment, serving as a cornerstone for ensuring the legitimacy and accuracy of the claims presented. The process of double presentment hinges on the successful validation of a claim. If a claim lacks proper validation, the second attempt at presentment might fail, potentially leading to disputes and complications in resolving the financial transaction. The importance of claim validation lies in its ability to prevent fraudulent or erroneous claims from impacting the financial system. A well-defined and robust claim validation process strengthens the integrity of transactions, enabling a dependable and trustworthy financial system.

Consider a scenario where a company receives a check that bounces. The initial presentment fails. Claim validation becomes crucial in determining if the bounce was due to insufficient funds, a procedural error, or potentially fraudulent activity. If the claim is for a legitimate payment, rigorous validation procedures can investigate the cause of the failure and support the company's subsequent claim. Correcting the issue (e.g., ensuring sufficient funds) and re-presenting the claim, following validated procedures, leads to a successful resolution. Effective claim validation is critical to maintaining the security and efficiency of financial interactions, preventing unwarranted challenges and fostering a climate of financial trust.

In essence, claim validation is the crucial filter within the double presentment process, ensuring that only legitimate and accurate claims proceed. This process protects both the claimant and the recipient from erroneous transactions, supporting financial stability. A robust claim validation mechanism is fundamental to a well-functioning financial system. Robust validation methodologies, incorporating thorough checks and balances, contribute to resolving transactions smoothly and effectively, preserving the confidence of all involved parties. This underlines the necessity of a robust process for claim validation as a key component of any financial framework designed for efficiency, trustworthiness, and stability. By preventing fraudulent activities and ensuring the legitimacy of claims, a well-executed claim validation process contributes significantly to a stable financial ecosystem.

8. Financial Integrity

Financial integrity is paramount to a functioning and trustworthy financial system. It encompasses the principles of honesty, accuracy, and reliability in financial transactions. Double presentment, as a process for resolving payment failures, directly impacts financial integrity. A robust double presentment system, with established procedures for handling payment discrepancies and a commitment to validation, reinforces confidence in the financial system. The integrity of financial instruments, like checks or promissory notes, is preserved by ensuring that claims are validated, corrective actions are taken, and subsequent presentations follow established protocols. Without such a system, irregularities in payment might go unnoticed, potentially eroding trust in the financial infrastructure.

Consider a scenario where a business receives a fraudulent check. The initial presentment fails. A robust double presentment process, including thorough investigation into the fraudulent nature of the check, will protect the business and help prevent further similar incidents. This diligence in handling questionable transactions underscores the importance of financial integrity. Conversely, a system lacking clear procedures or meticulous validation for double presentment can create opportunities for fraud and errors, jeopardizing financial integrity. The integrity of the financial system is, therefore, deeply dependent on the effectiveness and adherence to the procedures in a double presentment process.

The practical significance of understanding the connection between financial integrity and double presentment is multifaceted. From a business perspective, a system that prioritizes financial integrity through a robust double presentment procedure fosters confidence in transactions and reduces risks associated with payment failures. For financial institutions, upholding these standards through efficient double presentment practices safeguards their reputation and prevents damage to the entire financial ecosystem. Ultimately, financial integrity and effective double presentment procedures are mutually reinforcing, creating a system where financial instruments are trustworthy and transactions are resolved efficiently, thereby fostering public trust and confidence in the overall financial system. A system lacking such protections can lead to instability and the erosion of public faith in financial processes.

Frequently Asked Questions about Double Presentment

This section addresses common inquiries regarding the process of double presentment, a critical aspect of financial transactions. Clear answers to these questions aim to enhance understanding and provide clarity regarding this procedure.

Question 1: What is double presentment, and why is it necessary?

Double presentment is a process involving the presentation of a negotiable instrument, such as a check or promissory note, for payment twice. It's necessary to address situations where the initial presentation fails, often due to insufficient funds. The second presentation, following corrective action, allows for the successful resolution of the payment, safeguarding the rights of all parties involved and maintaining the integrity of financial transactions.

Question 2: Under what circumstances might a payment fail, necessitating a second presentment?

Payment failures can arise from various factors. Insufficient funds in the payer's account, errors in processing the payment, or disputes regarding the validity of the transaction are common causes. These issues necessitate a second attempt at payment after corrective action has been taken, like replenishing funds or resolving disputes. This ensures that payment is eventually secured and the transaction resolved.

Question 3: What constitutes corrective action in the double presentment process?

Corrective action directly addresses the reason for the initial payment failure. This could involve rectifying errors in the financial instrument, replenishing insufficient funds, or resolving disputes. The key is for the corrective action to address the specific reason for the initial failure, paving the way for a successful second presentment.

Question 4: What are the legal implications of double presentment?

Legal implications vary by jurisdiction. Statutes and regulations outline procedures for handling payment failures, including timelines for corrective action and second presentment. Understanding these legal requirements is crucial for ensuring compliance and preventing potential disputes or challenges to the transaction's validity.

Question 5: How does double presentment impact financial institutions?

Double presentment procedures directly influence financial institutions by establishing clear processes for resolving payment failures. This contributes to the stability and efficiency of the financial system. Robust protocols ensure payment is processed correctly, safeguarding the institution's reputation and minimizing the risk of errors.

Question 6: How does double presentment affect the speed and efficiency of transactions?

While double presentment may add a step, the process aims to achieve a timely and efficient resolution of payment issues. It minimizes the potential for delays and disputes associated with unresolved payment failures. Well-established procedures for double presentment can actually accelerate resolution, preventing prolonged uncertainty and enabling transactions to move forward.

In summary, double presentment is a structured approach to resolving payment failures, maintaining the integrity of financial transactions, and ensuring the reliability of financial systems. Understanding the process is crucial for all parties involved, ensuring that payment issues are addressed efficiently and legally.

The next section will explore the practical applications of double presentment across various sectors of the financial industry.

Tips for Navigating Double Presentment

Effective implementation of double presentment procedures is crucial for ensuring the timely and accurate resolution of financial transactions. These tips offer guidance for navigating the process, focusing on key aspects for successful outcomes.

Tip 1: Thoroughly Document Every Step. Comprehensive documentation is paramount. Detailed records of the initial presentment, the reason for failure, the corrective actions taken, and the subsequent presentment are vital. This documentation acts as a crucial record in case of disputes and serves as evidence of compliance with established procedures. Examples include precise dates, times, and descriptions of actions taken. Documentation should be readily accessible and organized for easy reference.

Tip 2: Adhere to Legal Timelines. Jurisdictional laws often dictate specific timeframes for corrective action and subsequent presentment. Failure to comply with these deadlines can compromise the validity of the claim and affect the legal standing of the involved parties. Careful adherence to statutory time limits safeguards against potential legal ramifications.

Tip 3: Identify the Root Cause of Payment Failure. Determining the precise reason for the initial payment failure is critical. Was it insufficient funds, a processing error, or a dispute? A thorough investigation into the root cause enables appropriate corrective action and enhances the likelihood of successful resolution during the second presentment. Ignoring underlying issues could lead to repetitive failures.

Tip 4: Implement Effective Corrective Action. The chosen corrective action must directly address the identified cause of the payment failure. If insufficient funds were the issue, replenishing the account is the appropriate corrective action. Other corrective actions might include resolving discrepancies in documentation, clarifying ambiguities, or addressing any other specific reason for failure. Effective corrective action is the cornerstone of successful double presentment.

Tip 5: Maintain Clear Communication Throughout the Process. Maintain consistent communication with all involved parties, including the payer, the recipient, and relevant financial institutions. This transparency ensures everyone is informed of the steps taken and the progress toward resolution. This reduces misunderstandings and clarifies expectations, especially critical when dealing with complex transactions or disputes.

Tip 6: Utilize Appropriate Dispute Resolution Mechanisms. Before resorting to litigation, explore available dispute resolution mechanisms, such as mediation or arbitration. These processes can be more efficient and cost-effective than prolonged legal battles. Knowing these options, and employing them appropriately, can minimize potential conflicts and streamline the resolution process.

Tip 7: Understand Jurisdictional Differences. Legal requirements and procedures for double presentment vary significantly across jurisdictions. A thorough understanding of the relevant regulations and laws applicable to the particular transaction is crucial. Lack of awareness of local laws can create legal complications.

Adherence to these guidelines supports the successful completion of financial transactions, upholding financial integrity, and minimizing potential disputes. The clear framework provided by these tips fosters trust and reliability in financial dealings.

The following section will analyze the applications of these principles across diverse financial sectors.

Conclusion

Double presentment, a process for resolving payment failures, is a crucial component of financial integrity. This article explored the multifaceted nature of this process, examining its significance across various financial contexts. Key elements discussed include the presentation of negotiable instruments, the handling of payment failures, the necessity of corrective action, and the legal implications surrounding second attempts. The importance of clear documentation, adherence to legal timelines, and effective communication were underscored as vital for success. Furthermore, the article highlighted the integral role of claim validation and its impact on preventing fraudulent activities. The interplay between corrective action, timely resolution, and dispute resolution mechanisms was also thoroughly examined. The overarching theme was the preservation of financial stability and trust through a structured approach to managing payment discrepancies.

The significance of double presentment extends beyond individual transactions. A robust system for double presentment is fundamental for maintaining the reliability of financial instruments and the overall stability of financial systems. Understanding the intricacies of this process enables participants to navigate potential payment failures effectively, minimizing disruptions and fostering trust in financial dealings. As financial transactions become increasingly complex and globalized, the importance of a robust double presentment framework will only grow. Further research and analysis into evolving legal frameworks and best practices are essential for maintaining and enhancing the integrity of this vital process.

You Might Also Like

Jimmy Kimmel & Guillermo: How They Met & Their Amazing Story!Best Caruso CSI Deals & Reviews

George Carlin's Homes: Where Did He Live?

Vanderbilt Family Net Worth: A Deep Dive Into Their Riches

Mariska Hargitay: A Powerful Advocate & Star

Article Recommendations